Treaty negotiators must consider the economic trade-offs required to support the transition to a circular plastics economy.

Key points:

- The plastics industry relies on large-scale and efficient value chains optimised over decades.

- Many policy tools and market-based instruments are available to account for the externalities created by the plastics industry. Finding the best policy mix for specific countries will be critical.

- Policymakers can create financial incentives and an enabling business environment to encourage investment in a circular plastic economy.

Since the UN Environment Assembly adopted a resolution to tackle the global plastics pollution crisis in 2022, experts and activists have debated how to bring dissenting voices together and what the outcome of a global treaty on plastic pollution treaty should be. If the treaty is to address the full lifecycle of plastics, negotiators will need to grapple with the economic model that underpins the plastics industry.

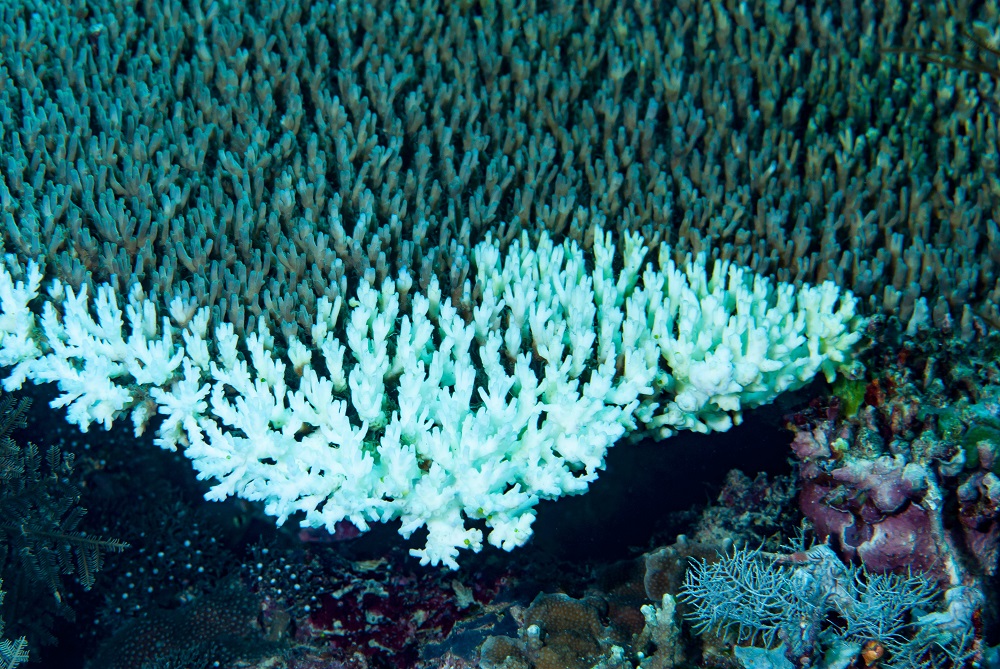

Plastic touches almost every aspect of our lives, bringing convenience, cost savings and versatility to our economies and societies. But it has also accumulated in landfills and oceans. Its negative impacts on the environment, human health, and the economy remain grossly unaccounted for in the price of virgin plastic.

Transitioning to a new plastics model that accounts for these externalities will be expensive, but the cost of inaction will likely be far higher. The cost of plastic on the environment and society could be tenfold what it reaches on the market. Without action, the annual flow of plastic into oceans could nearly triple by 2040. This is a high price tag for a seemingly cheap material.

How to fund the treaty’s implementation and create incentives that encourage the transition to a new plastic economy will be critical to the treaty’s success. Policymakers will need a toolkit of policy levers and market-based instruments that will enable them to simultaneously curb plastic production, create new markets for alternative products, drive responsible consumption and ultimately unlock the potential of a circular plastics economy.

The crutches of a well-oiled machine

Born of the petrochemical industry and built over decades, the global plastics industry is an enormous and well-oiled machine. The chemicals sector is ruthlessly competitive, as The Invisible Wave, a report from Economist Impact, outlined. Plastic producers must have well-optimised value chains and operate at an enormous scale to survive and thrive. Keeping such mammoth operations afloat requires considerable financial outlays.

Fossil fuel subsidies, such as tax breaks or payments to reduce production costs, keep prices artificially low, are expensive for governments to maintain, and prop up a heavily-polluting industry. Virgin plastic, made cheap by subsidised oil, is the material of choice.

But removing subsidies is notoriously difficult, especially during times of economic uncertainty. As economies recovered from the pandemic and energy prices increased, global public subsidies for fossil fuels almost doubled to US$697bn in 2021. Subsidies are expected to rise further due to sanctions on Russia. Removing this economic lifeline will be politically difficult, but doing so could redirect the revenue gain towards more sustainable business models and support the transition to a circular economy.

Yet the existing, fossil-fuel-intensive plastics industry is a lucrative investment for financiers searching for stable and predictable markets as demand for fossil-fuel-based energy wanes. Between 2015 and 2019, banks in the US and Europe bankrolled companies along the plastics supply chain to the tune of US$1.7trn. Looking forward, this trend has seen oil majors earmark US$400bn to invest in virgin plastic production over the next five years as they bank on the increasing demand for plastics to sustain their business model.

The sector for recycled plastics remains small and volatile compared with its much larger and more lucrative virgin plastic counterpart. Markets remain localised and fragmented, while waste collection and recycling facilities in many emerging markets are underdeveloped. Investments to support new solutions and technical capacity building are growing. Still, much more is needed to turn recycled plastic into a valuable commodity with an investable global value chain.

The true cost of plastic

It’s one thing to say that the plastics sector must transition to new economic models. Yet it is quite another to dismantle—or at least disrupt—a huge and well-established industry that contributes substantially to economies and has enormous lobbying power. The scale of the task, comparable to the transition from fossil fuels to renewable energy, should not be underestimated. It will be extremely complicated and fraught.

As with fossil fuel-based energy sources, “we [will] need a bigger conversation about how we value our materials,” says Bethanie Carney Almorth, professor and researcher at the University of Gothenburg. Negotiators will first and foremost need to consider the true cost of plastic for any solution to be viable and sustainable. We must “consider models in which producing virgin plastics is no longer the cheaper option,” says Ms Carney Almroth.

Policy levers at work

Several policy mechanisms and voluntary commitments, many described in the Breaking the Plastic Wave report, are being introduced to curb plastic pollution and create a more level playing field between virgin and recycled plastics.

“There are policy levers that can help make recycled plastics cheaper to produce and those that will make virgin plastics more expensive,” says Yonathan Shiran, partner and plastics lead at Systemiq and the report’s lead author. “Getting the policy mix right can close the gap between virgin and recycled plastics.”

Extended producer responsibility (ERP) is a financial and operational tool designed to internalise the externalities related to end-of-life management. It shifts the responsibility of waste management to producers and incentivises the inclusion of environmental costs in product design.

EPR has been useful when applied to risky products such as batteries, paint or medical sharps that are difficult to dispose of. But it can risk displacing small businesses that specialise in product repair and recycling that provide jobs and training to communities and low-cost equipment to schools, families and community centres.

Manufacturing guidelines, such as design-for-recycling guidelines (which result in products that are easier to sort and more readily recyclable) and recycled content targets (which stipulate that plastic products must contain a certain percentage of recycled content), can help curb plastic pollution. These measures can also help tackle the main bottlenecks of the recycling process by improving the quality and quantity of feedstock.

Manufacturers must be certain that they can obtain an ongoing supply of recycled plastic feedstock—at scale and of high quality—to justify investing in the new infrastructure required to build recycled plastic into the value chain. Right now, the sector suffers from different qualities of recycled material, contamination, inconsistent supply and lack of traceability. Enhanced product standardisation would increase the value and availability of recycled plastic, allowing it to be traded as a global commodity, similar to virgin plastics.

“Packaging companies are making commitments to increase the recycled content of their products, but they are struggling to meet their targets because of a lack of supply,” says Patrick Schroeder, a senior research fellow at Chatham House. “The system is not set up for a circular economy. Incentives, infrastructure and pricing models are misaligned. Market-based instruments can help redress this, but there must be a comprehensive approach. The treaty can provide this overall guidance at the global level.”

Existing tools, such as the World Bank’s Plastics Policy Simulator, can help policymakers assess the expected cost, revenue and impact of a combination of policy instruments before policies are passed into law and before public spending is required.

“Rather than see policy instruments as the output of the treaty, we look at them as inputs that carry an impact,” says Delphine Arri, a senior environmental engineer at the World Bank. “Understanding the menu of possible policy options and simulating their possible impacts is a powerful and transparent decision-making tool that can inform policy dialogue with various stakeholders, including private actors.”

These market-based instruments are useful to nudge the industry in the right direction, but unless they are deployed consistently and at scale, their effect will remain localised and tangential. Treaty negotiators will have to carefully assess the range of policy carrots and sticks to successfully devise a framework that can shift the economics in favour of a circular plastics model but also considers the enormous economic and political variations between countries.

Reality check: trade-off of a plastic transition

The disruption of any legacy industry will inevitably lead to unintended consequences and hidden social costs. An overemphasis on creating economic value may eclipse the social costs and considerations of the transition.

The issue of plastic waste disproportionately affects lower-income countries. Pacific Island nations contribute less than 1.3% of mismanaged plastics, but plastic pollution there could threaten the economic livelihood of a region that depends on the ocean for food security. Negotiators must strike a balance and develop rules that are more stringent for developed economies yet provide extra space for less developed economies to transition their plastics industries while minimising collateral economic damage.

“We need solutions tailored to different markets,” says Ms Arri. “Large economies, like Indonesia, have been champions of innovation, financing and policy reforms, but the focus should not be at the expense of small development states such as the Pacific Islands who are disproportionately affected. They need different attention and solutions to the plastics pollution.”

Many economies in Asia rely on plastics for growth, from production to consumption and waste management. The plastics economy involves businesses of all sizes, from producers and retailers to packaging and transportation firms. In 2018 Asia was responsible for 51% of global plastics production. Plastic manufacturing, in Thailand and Malaysia, for example, significantly contributes to employment and economic growth. Stakeholder involvement, from affected communities to civil society organisations, will be critical to developing and implementing alternative business models and employment pathways.

“A global deal on plastics needs to include suggested transition roadmaps and principles of change that are economically viable for these countries, not just copy-paste models from the West,” says Annupa Mattu Ahi, vice president of public affairs and head of Asia at Tomra, a plastic producer.

The informal sector has stepped in to run waste management and recycling activities in markets where the public sector is absent. For an estimated 15 million urban dwellers in developing countries, waste recycling is a common way to survive. Integrating waste pickers into waste management and capacity-building initiatives will go a long way towards organising and strengthening local supply chains and ensuring that workers are treated fairly, and working conditions are safe.

Building an investable circular plastics economy

Negotiators have a mammoth task ahead of them. Redefining the rules of the game for a new plastics economy will be disruptive and expensive. But there is no shortage of policy innovation and market-based solutions to spur that change. If deployed at scale, these measures could significantly de-risk private capital investments and further unlock the potential for an investable circular plastic economy.

Interviewees:

- Annupa Mattu Ahi, vice president public affairs and head of Asia, Tomra

- Bethanie Carney Almorth, professor and researcher, the University of Gothenburg

- Delphine Arri, senior environmental engineer, the World Bank

- Patrick Schroeder, senior research fellow, Chatham House

- Yonathan Shiran, partner and plastics lead, Systemiq

Back to Blue is an initiative of Economist Impact and The Nippon Foundation

Back to Blue explores evidence-based approaches and solutions to the pressing issues faced by the ocean, to restoring ocean health and promoting sustainability. Sign up to our monthly Back to Blue newsletter to keep updated with the latest news, research and events from Back to Blue and Economist Impact.

The Economist Group is a global organisation and operates a strict privacy policy around the world.

Please see our privacy policy here.

THANK YOU

Thank you for your interest in Back to Blue, please feel free to explore our content.

CONTACT THE BACK TO BLUE TEAM

If you would like to co-design the Back to Blue roadmap or have feedback on content, events, editorial or media-related feedback, please fill out the form below. Thank you.

The Economist Group is a global organisation and operates a strict privacy policy around the world.

Please see our privacy policy here.

World Ocean Summit & Expo

2025

World Ocean Summit & Expo

2025 UNOC

UNOC Sewage and wastewater pollution 101

Sewage and wastewater pollution 101 Slowing

the chemical tide: safeguarding human and ocean health amid

chemical pollution

Slowing

the chemical tide: safeguarding human and ocean health amid

chemical pollution Hazardous chemicals in plastics - the discussions at INC

Hazardous chemicals in plastics - the discussions at INC