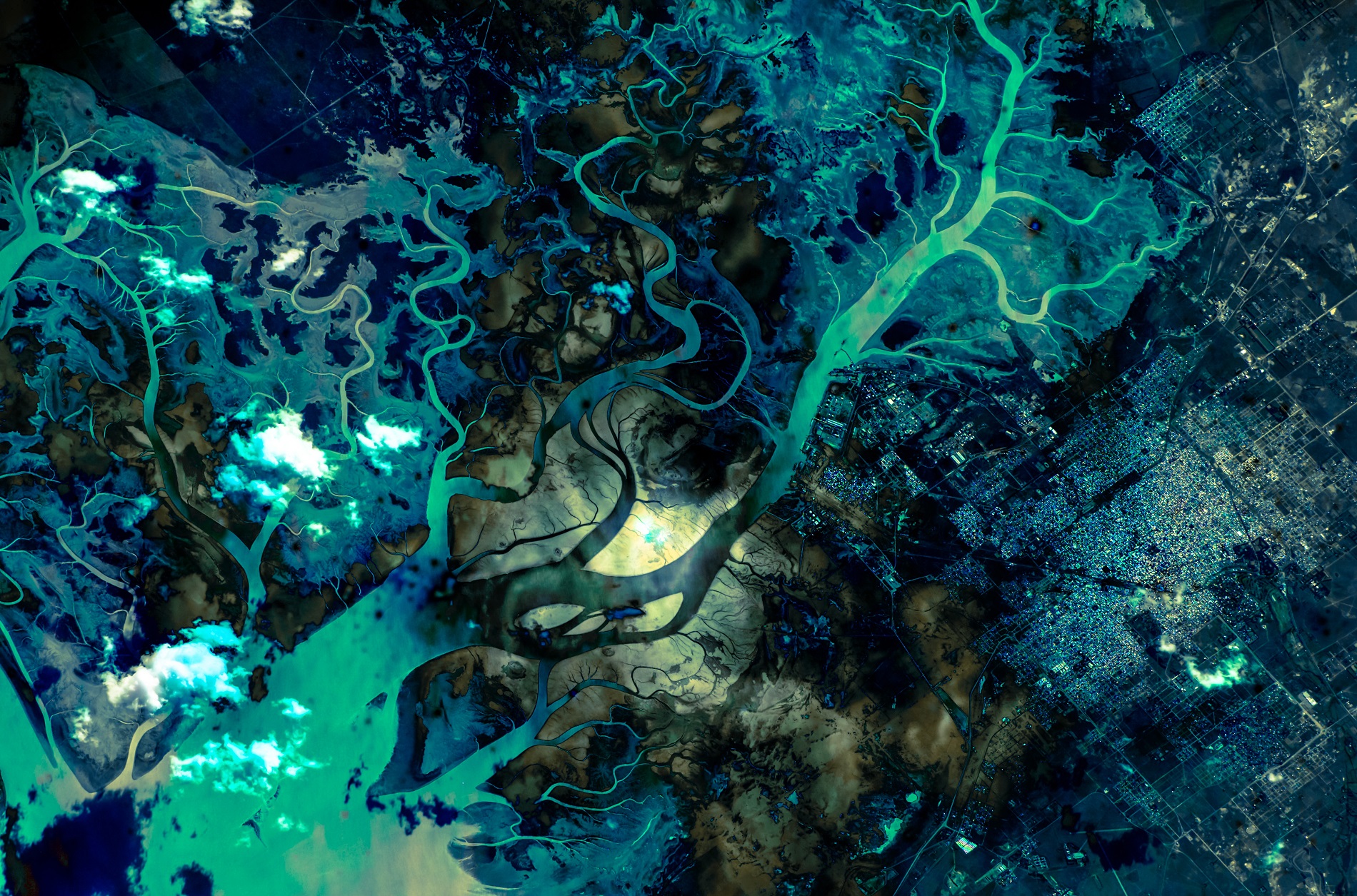

“Chemical pollution is not just creating a nutrient imbalance in the ocean, but actually creating new chemistry,” Solugen’s founder, Gaurab Chakrabarti, comments. The carbon balance between the atmosphere and what gets dissolved into the oceans is precarious, he explains. “That’s what helps keep a lot of greenhouse gases out of the atmosphere, particularly CO2. But if you start creating a more acidic environment, because of the chemistry that we’re dumping in there, or if the chemistry gets metabolised into more acidic end products by the bacteria in the ocean, you are turning that carbon sink off kilter. It’s not just ecotoxicity to aquatic life but to the climate itself.”

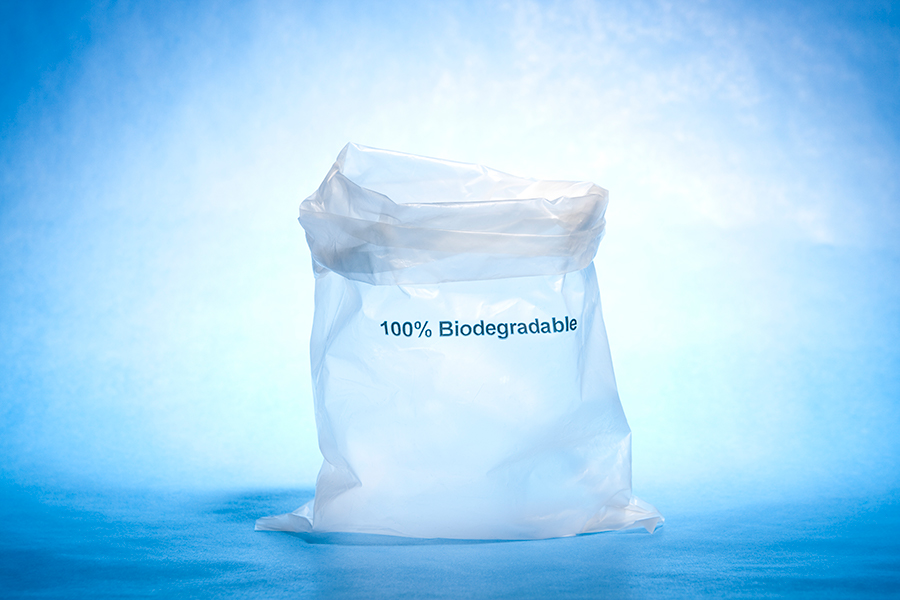

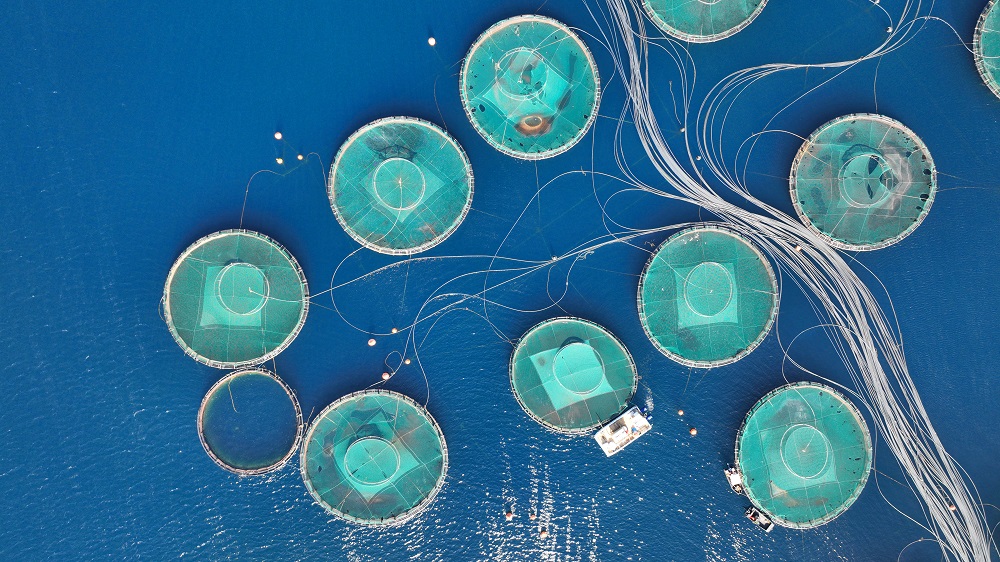

One of Solugen’s molecules competes with phosphates, used in fertilisers. “When phosphates run off from agriculture into water systems, that leads to algal blooms and dead zones, because the algae are consuming all the nutrients and oxygen in the water system so the local aquaculture can’t exist,” explains Mr Chakrabarti. “The fish can’t live because there’s not enough oxygen in the water for them to be healthy and the algae on top of that create pretty nasty conditions for life”. In developing their new class of clean, sustainable molecules, Solugen is focusing not just on cleaner production (with a wind-powered factory), but also on molecules that biodegrade at the end of life.

The scourge of untreated wastewater

The scourge of untreated wastewater Slowing

the chemical tide: safeguarding human and ocean health amid

chemical pollution

Slowing

the chemical tide: safeguarding human and ocean health amid

chemical pollution Hazardous chemicals in plastics - the discussions at INC

Hazardous chemicals in plastics - the discussions at INC